Signal Over Noise: How Bitvocation Defines Bitcoin Companies in Its Job Market Data

... and How This Definition Affects Signal, Volume, and Job Visibility

At Bitvocation, a surprising amount of our internal work isn’t about scraping more jobs — it’s about deciding which jobs should exist in the feed at all.

Throughout 2025, we’ve spent a lot of time exploring one difficult question:

What actually qualifies as a Bitcoin company?

Not philosophically — but practically. For a scraper. For a job feed. For people who want signal, not noise.

The problem with defining “Bitcoin companies”

At first glance, this should be straightforward. In reality, the Bitcoin ecosystem is layered.

There are:

Bitcoin-only startups

Bitcoin-first companies

Bitcoin-adjacent companies

Exchanges, miners, energy companies, Bitcoin Treasury companies

Multi-currency software and hardware providers

All of them offer Bitcoin-related services. Many also offer other services or cryptocurrencies. Some pay their staff in Bitcoin. Some publish dozens of job openings in a single day.

The real challenge is deciding which companies and roles are relevant to our audience.

All of them are interested in Bitcoin — but they relate to it differently, and some are more “maxi” than others.

Our working definition of a Bitcoin company

As a foundation for our discussions, we’ve been working on an internal definition of what we consider a Bitcoin-only company:

Bitcoin-only products

Core products and services are exclusively focused on Bitcoin, with no competing cryptocurrencies.Publicly stated commitment

The company explicitly identifies as Bitcoin-only or Bitcoin-focused in its mission or communications.Ecosystem contribution

Active participation in Bitcoin development, open-source projects, or the Bitcoin community.

This definition creates clarity and distinction. We’re not optimizing for maximum coverage or quantity — we’re optimizing for quality and signal.

Once you adopt a stricter definition, the downstream effects on the job feed become obvious.

Signal vs. volume

Here’s the challenge.

On one side:

Bitcoin-adjacent companies dramatically increase job volume

Larger companies post more frequently

If our only focus were impressions and reach, this would be great for us

On the other side:

A single company can dominate the feed for an entire day

Smaller Bitcoin-only startups get buried

The feed becomes noisy, harder to scan, and cognitively expensive

We could optimize for volume and growth.

But we keep coming back to the same question:

Who is the feed actually for?

Why we lean toward signal

The Bitvocation job feed is meant to be high-signal for Bitcoin Professionals.

In practice, that might mean fewer jobs — but higher relevance per scroll.

Where Bitcoin-adjacent jobs fit in

Importantly, none of this means Bitcoin-adjacent jobs aren’t valuable.

They absolutely are.

What we’re exploring is a separation between signal and subjective completeness.

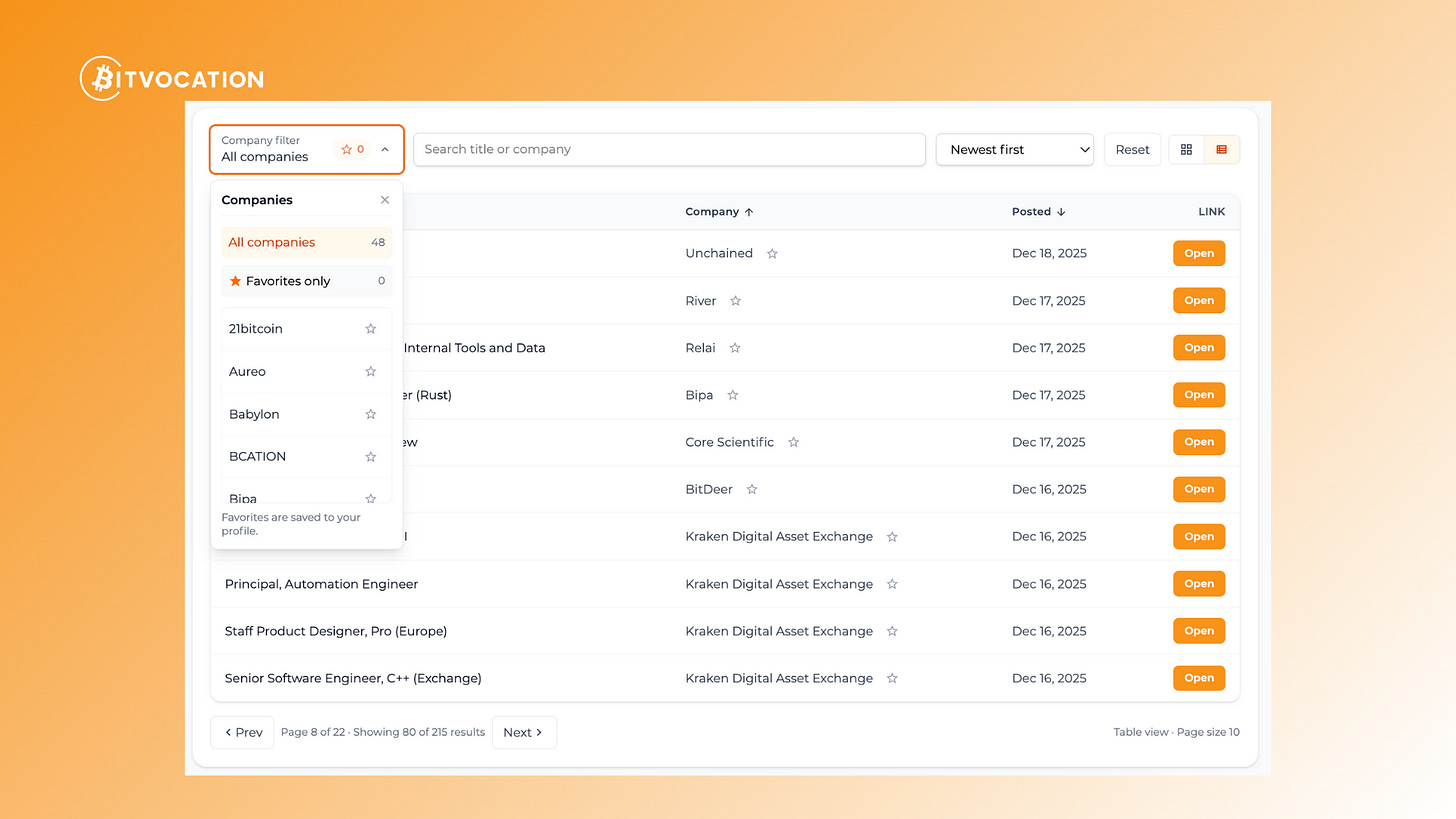

Our new web-based version of the job feed allows us to do exactly that, and it will be available as part of the POW Lab. Going forward, we’re separating the POW Lab into a Pro and Lite tier — both of which include access to the web feed.

Subscribers will have the ability to:

access a full web-based job feed

see a larger number of jobs, including Bitcoin-adjacent companies

filter, search, and set “favorite” companies to follow more closely

avoid overwhelming public channels

In other words:

the public feed can stay focused for those who prefer high-signal and “less is more”

active Bitcoin job seekers who want more can opt into depth and breadth

This structure did not exist in our job feeds in 2025. Over the course of 2026, we plan to implement this distinction more clearly — even if that reduces total job volume or impressions. The goal is not “more jobs,” but better signal.

Any Bitcoin Professional who wants to cast a wider net — by seeing Bitcoin-related jobs in an organized, non-overwhelming way and becoming part of our talent pool — can do so by supporting Bitvocation with a small amount of sats via the POW Lab.

We believe this approach better serves different segments of our audience and meaningfully addresses the signal-over-noise challenge.

This article expands on the data and methodology behind our 2025 Annual Bitcoin Job Market Report. [Link will be provided here once avaialable at the end of January.]